RISR helps you earn trust with business owner clients faster by showing them you understand and care about their most important asset (their business).

Increase speed to trust

Whether you are prospecting with new business owners or trying to better engage your existing client base, organic growth is all about speed to trust.

RISR helps you earn trust with business owners faster by showing them you understand and care about their most important asset (their business).

Start by offering a valuation estimate

Owners are always interested in speaking about the potential value of their company.

Offering a valuation estimate to a prospective or existing owner client is an effective hook to open the door to meaningful conversations around wealth, risk, and planning.

A valuation estimate is also a great opportunity to capture the business data you need to provide relevant value in the future.

Example email to generate interest

Hi {name},

You have worked hard to build your business. We are here to help you optimize and protect that value so you can achieve your life goals.

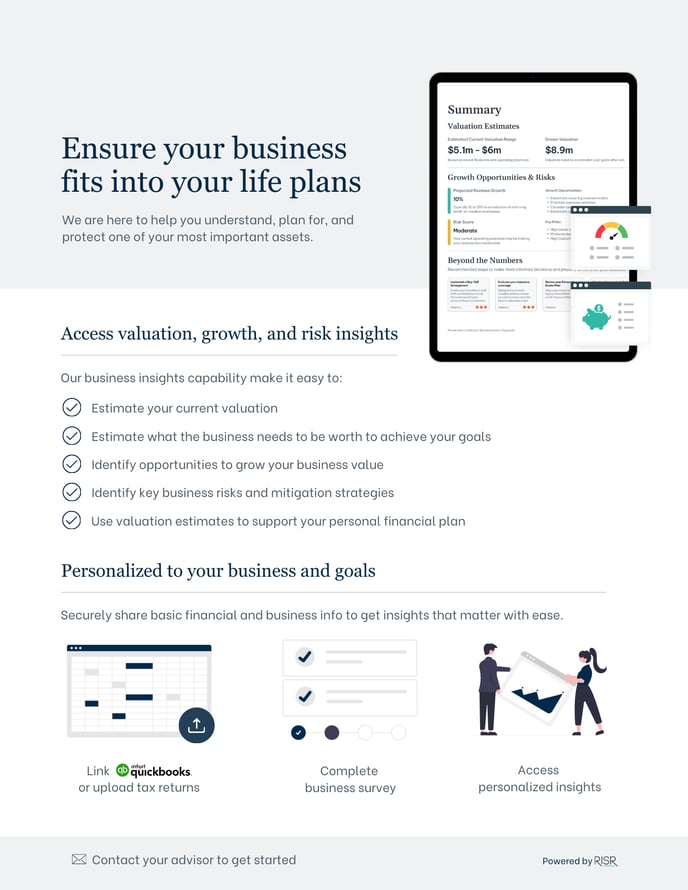

- Estimate your current business value

- Estimate the valuation needed to accomplish your goals

- Identify growth opportunities to reach your goal valuation

- Identify key business risks and mitigation strategies

(PDF provided during RISR onboarding)

Identify the hidden risks surrounding their business

Advisors that help clients detect hidden pitfalls earn trust more quickly.

Finding hidden risks, educating prospects on the implications, and giving them options for taking action against them is a powerful playbook for building deeper relationships.

For business owners, risk management covers a variety of conversations:

- Concentration of wealth in the business asset

- Risks to the business that may impact future income or valuation potential

- Life and legal risks that impact the owner’s ability to protect and capture the value of the business

RISR makes it easy to start risk management conversations by:

- Providing a valuation estimate that you can compare to their total portfolio to assess wealth concentration

- Generating a full business risk assessment across owner & key employee dependency risks, vendor concentration risk, customer and revenue quality risks, and more. (Example right)

- Identifying the entity structure of the business and the types of insurance the owner has in place today.

- Surfacing recommended next steps across buy-sell, key person, and business overhead expense insurance

Identifying these risks to business owners shows them you’re there to protect the value they have worked so hard to build.

Use business insights to maintain engagement

Maintaining engagement with prospects is the hardest part. Prospects can easily disengage between meetings, especially when they are focused on operating their business.

For owners that are operating their business daily, touch points related to their business are hard to ignore.

Sending them key insights around their business valuation, growth opportunities, and risk profile creates surface area for you to better understand how they see their business fitting into their life goals.

💡 Check out our Guide to Engaging Business Owners to learn more

Deliver!

With your foot in the door and opportunities to open meaningful conversations, you can do what you do best: deliver great advice.

-2-1.png?height=120&name=RISR-Brand_Full%20Logo%20Full%20Color%20(1)-2-1.png)