Sharing Data in RISR - What to Expect - Watch Video

First, let’s talk about the financial data fields in RISR. A three-year Profit & Loss statement and a most recent year’s Balance Sheet are being populated when you aggregate, upload, or enter data. At the bottom of this article are the list of data fields we capture in the P&L and Balance Sheet. Specifically within the P&L page, we allow (and encourage) you to enter adjustments to normalize a company's earnings. This field is treated as an “add-back” to Net Income and EBITDA for the valuations as this can better illustrate the transferrable value of a company.

Note that no matter which data entry method you choose to use, both you and the business owner will have opportunities to review and/or edit the data fields before generating a final Insights Report.

The more data the better – as in, please provide three years’ worth of P&L data. Our software can derive a more accurate valuation this way.

Now let’s cover the three ways to enter data into the RISR platform:

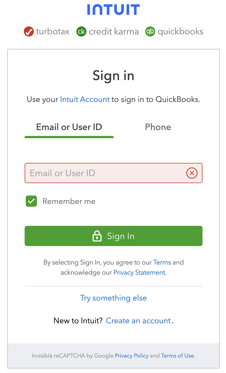

1. QuickBooks Online integration

2. Document uploader, and

3. Manual data entry

2. Document Uploader: Another easy method is using our Document Uploader. We've built our Uploader using best-in-class AI that we believe achieves a near 100% accuracy rate. We rigorously test the solution to optimize for reliable results.

If you are uploading a corporate tax return we recommend you use a PDF file that has the numbers and fields typed in as this presents the most legible format. This will expedite turnaround time when you upload the document, otherwise, it might take longer than usual for our software to read through the doc and identify necessary data. Anything of less quality – i.e., a picture of a return you take with your phone, a return with written-in numbers, etc. – will potentially yield fewer fields being identified.

Our uploader can intake the following documents and corporate tax returns. Check out more in our Document Uploader FAQ's article:

- RISR's Fact Finder PDF

- 1120

- 1120-S

- 1065

- 1040 Schedule C

After submitting data via our document uploader, we recommend reviewing and verifying the results.

3. Manual data entry: If you prefer another method, you may always manually enter the data into RISR. Below are the data points you will need to fill in during your data entry process:.png?width=688&height=686&name=image%20(8).png)

If you ever have additional questions, always reach out to us at help@risr.com

-2-1.png?height=120&name=RISR-Brand_Full%20Logo%20Full%20Color%20(1)-2-1.png)